Investors commonly find themselves considering both Vanguard and Dimensional Fund Advisors (DFA) mutual funds. These two popular companies offer broadly diversified investments that shy away from active stock picking.

But there are a few differences between the two. For one, DFA is a for-profit corporation, while Vanguard operates at cost and exists solely for the benefit of its customers. For another, Vanguard funds can be purchased directly by investors, while DFA funds are only available through financial advisors.

They also have somewhat different investment approaches.

Vanguard investors typically follow a strategy of buying and holding the entire stock market at the lowest possible cost. “It’s impossible to outperform the market consistently,” this philosophy goes, “so we’ll just try to capture the full return of it.” While Vanguard does offer active and other non-total market funds, its largest funds, and the ones it chooses to include in its Target retirement portfolios, reflect this total market philosophy.

DFA, while also subscribing to the low cost passive model, employs a number of strategies it claims will produce better results for shareholders than simple indexing. These include:

- Favoring smaller companies.

- Favoring so called “value stocks”, defined by DFA as those with higher than average book values per share.

- Favoring “momentum” strategies, which hold stocks that have done well in the recent past.

- “Patient trading” – buying and selling stocks strategically instead of blindly following an index to manage costs and allow for less liquid holdings.

- Retaining broad diversification by holding less of, but still owning, stocks not meeting these criteria, such as large and growth stocks.

So, does the DFA approach give them an edge over simple indexing? In the past, it was hard to tell. DFA advisors would invest customer money in a number of its 28 funds, each capturing different bits of their strategy. It was difficult to determine, from its scattered (and often overlapping) individual funds, how a DFA portfolio as a whole might perform.

Almost a decade ago, however, DFA launched a product incorporating its entire philosophy into a single investment. On December 30, 2005, the DFA US Vector Equity Portfolio (DFVEX) was born. No longer would DFA advisors have to buy a large number of funds and rebalance among them, possibly incurring capital gains taxes along the way. The Vector fund was all you needed.

We now have 9 years of real world data on this investment. This is also recent data, a fact especially important in the case of DFA, which was a tiny fund family for most of its 30 year existence. Even a decade ago, it was only about 10% the size it is now. Since many of its strategies (such as buying smaller and less liquid stocks) become harder to execute as fund size grows, data from the distant past may not be relevant today. An example of these growing pains may be seen in the rebranding of its original fund, DFSCX, from “small cap” to “micro cap”, and creating new “small cap” funds holding larger stocks.

To be clear, DFVEX covers only the US stock market. Vanguard investors have a similar all-in-one US stock investment, the Vanguard Total Stock Market fund, VTSAX. Unlike the many active strategies DFA uses, VTSAX holds stocks purely based on their size, or market cap. The bigger the stock, the more it holds. VTSAX employs no sophisticated market beating strategies. It just sits there.

Now, on to the comparisons.

Performance

Let’s get the big one out of the way. Which fund has done better for shareholders? (Data updated in 2019)

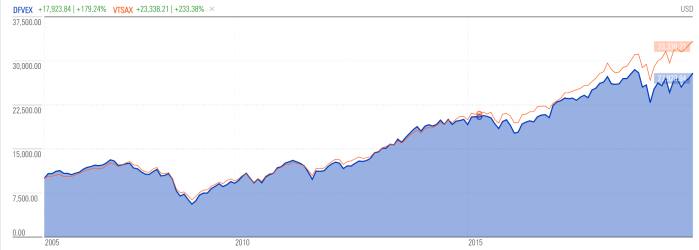

As we’d expect, these funds have had very similar returns, since they both broadly cover the US stock market. In this chart from Morningstar, we see that a $10,000 investment in each fund since DFVEX’s inception resulted in a gain of $17,923 for DFA, and $23,338 for Vanguard.

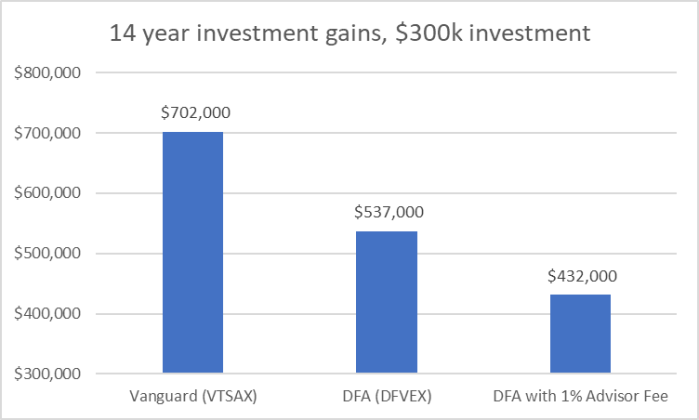

Of course, that excludes the advisor fee investors using DFA advisors must pay. Here’s the growth of a $300k initial investment, with and without a 1% advisor fee:

That’s a stunning difference in results.

Winner: Vanguard – by 1.4% per year, or 2.4% with advisor fees.

Cost

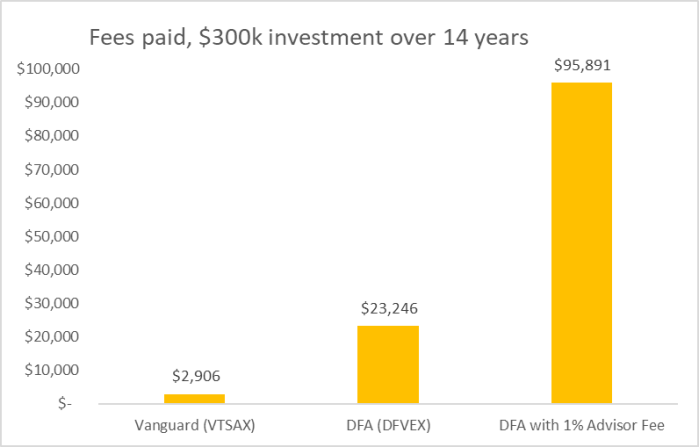

Vanguard’s performance advantage is due in small part to its lower cost. For the pleasure of underperforming the market, DFA charges exactly 8 times the annual expense ratio of Vanguard – .04% for VTSAX versus .32% for DFVEX. With a 1% advisor fee you’re looking at not 8 times, but 33 times the annual cost of the Vanguard fund. Here’ how these costs add up with that $300k investment, over 14 years:

Those are terrifying numbers. The additional expense of the DFA option compounds dramatically over time.

Winner: Vanguard by a landslide

Risk

When comparing investments, risk must always be considered. High risk stocks, for example, have had greater returns than low risk government bonds historically, but we can’t simply declare stocks the better option, since they were also so much riskier.

DFVEX and VTSAX should have similar risk, since they’re composed of mostly the same US stocks. However, the DFA fund holds out-sized amounts of more risky parts of the market (mainly small caps). It’s also arguably less economically diversified, as it makes relatively large bets on stocks the market has assigned smaller values to.

One way to measure risk is to simply look at volatility – how much the price of the fund varies from day to day. As of November 2019, per Morning star the 10 year volatility of DFVEX is 15.9% versus 12.9% for Vanguard. The DFA fund is clearly riskier.

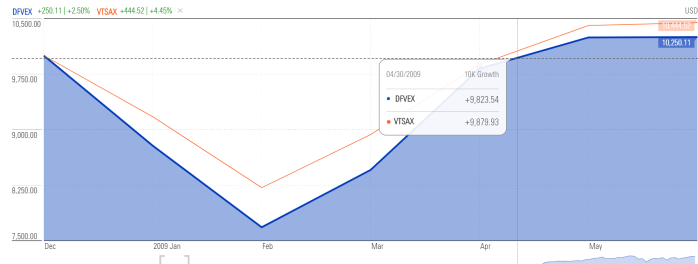

In the real world, this means your DFA fund is likely to fall further during the next market crash. The 2008-09 financial crisis and recession is a perfect example of this. Let’s look at how both funds behaved:

The graphic above shows that the Vanguard fund dropped 18% during the crisis, while the DFA fund dropped by 24%. DFVEX was the riskier of the two investments.

Winner: Vanguard, any way you slice it

Conclusion

It’s important to note that we’re not just comparing DFA to Vanguard. VTSAX represents the US stock market itself. The real question is, then: do DFA’s strategies have any value at all? It appears from the data that the answer is no.

To be the superior investment going forward, DFVEX will not only have to outperform in absolute terms, but on a risk adjusted basis as well. Given its cost and the historical data so far, the odds of such as feat are greater than zero, but not much greater. Since DFVEX is representative of a typical DFA advisor portfolio (or at least the US stock portion of it), I believe most DFA clients should expect similar results.

When you go to the market, do you compare an Apple to an Orange? They are both fruits.

First some facts. Small cap is more volatile than large cap. Trading small cap is more costly than large cap. Would you agree to these two facts?

If so now look at the funds that you dare to compare.

VTSAX is 72% large, 18% mid and 9% small.

DFVEX is 29% large, 29% mid and 42% small.

As a result of the make up of the two funds you would expect more trading cost and volatility with the fund with more small cap.

If you want to compare a DFA fund that is more similar, compare the DFA Equity Core DFEOX to the Vanguard Total stock market.

LikeLike

The answers to your questions can be found in my blog post, and on the DFA web page describing their all in one, total market funds.

The comparison is apples to apples because it compares two US total stock market funds. As I stated repeatedly, DFVEX does favor small, value, momentum, etc., and the efficacy of this is exactly what we’re testing.

While DFA does have two “Vector light” funds, which they call “Core” funds, these merely implement their trading strategies to a lesser degree, so it would be like comparing VTSAX to a portfolio of 2/3 VTSAX and 1/3 Vector (DFVEX). With VTSAX and DFVEX already being almost perfectly correlated (see my graph), an even weaker comparison would hardly isolate any value DFA is adding.

LikeLike

Larry Swedroe and other advisers recommend using the DFA small value fund, DFSVX. What is the difference between this and the vector fund in your article?

LikeLike

DFSVX isn’t directly comparable to VTSAX because it captures only one small corner of the total US stock market. The DFA website explains that small value and other funds are merely “component asset classes”, while DFVEX (and their other “core” funds, Core I and Core II, which are less concentrated all-in-one DFA trading strategies, see mid-way down the page) “adopt the total market approach by targeting return premiums across the multiple asset classes of the US equity market.”

DFA goes on to say: “Because the core equity architecture is seamlessly integrated across the full range of securities, the turnover and transaction costs normally associated with maintaining multiple components are strongly reduced.”

So comparing a small value, small growth or another DFA component fund to the Vanguard Total Stock Market fund would be wrong, since we wouldn’t be comparing total market strategies. We could compare a group of DFA funds approximating a total market investment to VTSAX, but the Vector fund gives us the same comparison in a single investment.

LikeLike

Interesting analysis. DFA’s golden years are well in the past, but you have to admit they have an incredible marketing strategy. DFA corporate wows you with high minded talk of their academic approach and in house Nobel Laureates, while DFA advisors take the traditional sales approach with subtle promises of easy outperformance.

LikeLike

The DFA US Vector fund is about 50% as “tilted” as the DFA US Small Value fund. Put another way, it’s like owning 50% Russell 3000 Index and 50% DFA US Small Value fund. From 1/2006 through 11/2014, the Russell 3000 Index earned +8.2%, DFA US Vector did +8.0%, and DFA US Small Value did +7.7%. So while small value stocks haven’t outperformed the market over the last 9 years, the US Vector fund has done what it’s supposed to – earn about 50% of the “small cap value stock premium”, even if it’s a deficit.

LikeLike

DFVEX has indeed done its job of overweighting small and value stocks, which as you note will sometimes offer a premium, and sometimes a deficit. We could also create a fund overweighting health care stocks, which would have similar periods of both out- and under-performance. The question is, especially after adjusting for risk, has the market left us a free lunch in any of these areas? The results here, as well as common sense, confirm that it has not.

LikeLike

To short of a timeframe.

5 year rolling average returns from the US stock market, 1926-2012: Value beats Growth 80%

10 year rolling average returns from the US stock market since, 1926-2012: Value beats Growth 91%

15 year rolling average returns from the US stock market since, 1926-2012: Value beats Growth 95%

25 year rolling average returns from the US stock market since, 1926-2012: Value beats Growth 100%

5 year rolling average returns from the US stock market since, 1926-2012: Small beats Large 60%

10 year rolling average returns from the US stock market since, 1926-2012: Small beats Large 75%

15 year rolling average returns from the US stock market since ,1926-2012: Small beats Large 82%

15 year rolling average returns from the US stock market since, 1926-2012: Small beats Large 95%

Historical size of annual average risk premiums over this period: Small – 3.73%, Value – 5.08%

Knowing you have to make a bet on the future, where would you allocate today’s capital?

Comparing fees, a 0.70% advisor fee or even 1.00% as is more common in Canada and a .30% difference in management fees would still have beaten Vanguard over the majority of holding periods.

Common sense suggests small and value if you are risk neutral.

LikeLike

Those numbers certainly look appealing, Q, and are used to sell funds using DFA strategies everyday. There are a couple of problems here, though.

One, they were essentially invented by Fama and French/DFA (especially pre-1962 data), and don’t reflect any return any investor ever achieved. Actual fund returns, even those going back decades, show no return advantage of value over growth funds, for example. And while small caps have had long periods of both good and bad performance, there’s no evidence, on a risk adjusted basis, they’re better than any other stocks.

Two, you state: “Common sense suggests small and value if you are risk neutral.” . This is a strikingly naive view of the market, suggesting it has charitably left us free lunches in certain areas and will continue to do so. What common sense should tell you is that markets are highly efficient, and such free lunches would be snapped up in seconds when exposed. My data, using real fund results, shows no evidence of such easy money.

LikeLike

I’m a new passive ETF DIY investor and I read your post carefully.

I understand that lowering costs is essential to optimizing returns, but if a small-cap/value-tiled portfolio can generate excess risk-adjusted returns (alpha?) it should overcome these costs (as long as they’re reasonable) and generate a higher return than a standard cap-weighted index over time.

Are you essentially saying that there is no ‘premium’ (excess risk-adjusted return) to value/small stocks ?

If so, then a cap-weighted ETF is the way to go, even preferable to a Vanguard ETF-portfolio which is ’tilted’ to small-cap/value stocks, correct? This is very different than what I’ve read in the texts which support passive investing (Swedroe etc…)

Thanks in advance,

Jamie

LikeLike

Jamie, that’s right. what I’m saying (and showing), is that these “premia” (small, value, momentum, I believe DFA has dreamed up a few others) don’t exist in real fund returns. They’re merely a marketing ploy, pulled from a back-filled data set nobody actually ever invested in. Markets are rational and efficient, and haven’t left you any free lunches, as common sense would dictate. And in this, case, the best strategy is to minimize fees and taxes, and maximize diversification, with a total market fund. If the sources you’re reading also happen to sell DFA funds for a living, you should be very skeptical of their claims.

There will certainly be times when segments of the market outperform others. The Vanguard Small Value fund has done well lately, but would have been a disaster in the 1980s and 90s. Those making large bets on it today are simply performance chasing.

LikeLike

Hi Steve,

I discussed your input above with my advisor who recommended me DFA.

He came up with this article.

https://www.ifa.com/articles/dfa_versus_vanguard/

Here the data & conclusion is totally contrary to yours.

Please help me figuring this out toward a final conclusion.

Regards,

Jan

LikeLike

Hi Jan. Investing with DFA appears to have been mostly been a bad bet since it opened for business in the early 80s. For example, in the 80s and 90s it bet on small caps at the time when they were overvalued and underperforming.

And as I’ve shown, DFA has done poorly in the last decade.

So what explains the outperformance in the article you linked to? Well, for a brief period beginning in 1999, while DFA was still a small company, some of their US funds did very well.

Maybe, being so small, they were able to exploit inefficiencies that existed briefly in the market. Maybe they just got lucky. Whatever happened, the glory days ended as quickly as they began, but DFA advisors are still selling funds based on that period.

The pattern with active mutual funds is always the same – a brief period of outperformance, an explosion in fund size, a lot of marketing, and underperformance thereafter. And that’s why the marketing materials you linked to began conveniently in 1999. Without those few years of lucky results in the distant past, DFA doesn’t have much to sell.

LikeLiked by 1 person

Hi Steve,

Thanks for answering my question.

I checked the DFA funds offered in Europe and they are all underperforming vs Vanguard during the last 10 years when taking the costs (1%) into consideration. So your point is definitely proven.

My advisor (who makes a living of selling DFA) was struggling when I discussed this with him but eventually agreed to the facts. He confirmed that the last 10 years investing in Vanguard funds would have been better. He then came with the following explanation: during the last 10 years, due to the financial crisis US & EU governments have been adding an enormous amount of money in the financial markets and this “cheap” money has found its way to high value stocks causing DFA funds underperformance. In his view this is not “normal”. He advised me to wait it out until the market corrects itself to benefit from the value factor of the DFA funds. Another point he added: currently the DFA emerging value fund has a value ratio of 9,9 which is historically lowest. Waiting it out or even increasing its weight in my portfolio would also give the benefits DFA promises in the long run. And indeed he always uses decades of statistical date to make the point that the DFA factors are key in the long run, eg value.

Correct me if I am wrong but to me it sounds very logical that value is an important factor.

I am very interested in your view about these arguments.

Regards,

Jan

LikeLike

Hi Jan,

Your advisor is right that value will outperform growth during some future periods, just at technology stocks will outperform financials at times, Europe will outperform Japan, etc. But is there any reason to believe value will outperform growth overall?

DFA gives two possible reasons they might. The first is that the stock market somehow misprices value stocks, leaving savvy investors a free lunch there. To believe this, you’d have to also believe the institutions that make up the bulk of stock ownership are dumb enough to leave billions of dollars in free money on the table for small time investors to scoop up. Having worked on Wall Street, I don’t believe that. Even your local housing market is highly efficient. The US stock market is devastatingly so.

The second reason is that value stocks are riskier, and investors are being rewarded for some additional factor risk there. To believe this, you’d have to believe that technology stocks with P/E ratios of 100 are relatively low risk, while boring, low P/E stocks like financials are high risk. I don’t believe that either, in fact I think the opposite is true.

The bottom line is that while DFA has a very sophisticated marketing strategy, marketing is all it is. Take a look at the 2015 Callan Table of Investment Returns, showing how both large and small cap growth have performed each year over the past two decades:

https://www.bogleheads.org/wiki/Callan_periodic_table_of_investment_returns

All you see is randomness. And that’s all the future will provide – stock prices move based on new information, which by definition is unpredictable. Common sense tells you the good news won’t predictably fall on value stocks.

Finally I’d ignore those “decades of returns” your advisor showed unless they were actual mutual fund results. Made up return series, with no transaction costs, and the ability to include tiny illiquid stocks that can’t be held in practice, can prove just about anything. For example in some periods, especially prior to 1962, the small deep value stocks that drive those returns were limited to a couple of penny stocks.

Thanks for stopping by,

Steve

LikeLike

It appears DFA caved in to the ETF game and now offers 3 US / Int developed / Int emerging. Though ER is higher than vanguard they’re relatively low compared to other offerings.

LikeLike

Right, the DFA ETFs, which allow you to avoid the advisor fee layer, are far better than the funds. They should still underperform a total market fund though, and with more risk.

LikeLike